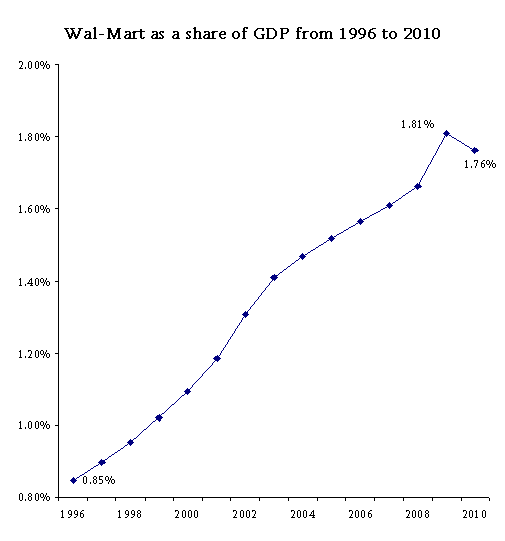

How big is Wal-Mart? The answer is pretty big! The growth of productivity at Wal-Mart, matched by real wages growth, has allowed the corporation to cut prices systematically and provide consumers with a service they really desire. This has resulted in growth that is faster than the overall rate of economic growth.

This is illustrated in this graph below which represents the domestic sales of Wal-Mart in the United States as a share of GDP. The data set is available in the “data sets” section of my website and you can consult it freely.

If you think that this rise is meteoric, consider that according to Cox and Vedder in their 2004 book entitled The Wal-Mart Revolution, in 1980 Wal-Mart’s sales as a share of GDP stood at 0.04%

If you think that this rise is meteoric, consider that according to Cox and Vedder in their 2004 book entitled The Wal-Mart Revolution, in 1980 Wal-Mart’s sales as a share of GDP stood at 0.04%